Can Transparency Bring More Efficient Sourcing?

A resource that aims to be free for machine shops asks detailed capability information so parts can be matched to producers, and OEMs can target RFQs to shops that are ready to run the work.

Share

It is not hard for an OEM in need of machined parts with specific requirements to find a machine shop able to meet the need. The problem lies in also finding so many other shops at the same time that are not quite suited to the work. How does the buyer identify which of the shops that seem promising is actually a good fit?

And it is not hard for that same buyer seeking machining work to find shops with open capacity, even open capacity for particular machine types and travels. The problem is that capacity is not a commodity. Different shops use their capacities in different ways.

All of this is as much a problem for machine shops as it is for buyers of machining services. The overabundance of RFQs that shops contend with and sort through is in part a result of the lack of transparency, and the lack of knowledge, between manufacturing buyers and providers. Ironically, shops would be aided by a platform that would accurately characterize and filter them, and therefore in many cases accurately exclude them from consideration.

A group of supply-chain professionals formerly with SpaceX is now working to develop exactly this platform. Their company is , and the platform they aim to commercialize is based on “radical transparency” into supplier capabilities, says CEO Robert Pakalski. I recently spoke with him about the company, its aims and what role it might play in buyer/supplier relationships of the future.

Significantly, he says only half of Datum is supply-chain experts. The startup’s staff of 10 at the moment I spoke with him included five from the supply-chain world and five with software expertise. The problems supply-chain leaders encounter are in some cases solvable using data the part file contains, he notes, if only the data can be effectively leveraged. The logic-based sourcing platform Datum is building interrogates CAD files in order to identify relevant machine types and machine travels, and in this way identify suppliers.

“Machine shops are not apples to apples,” Pakalski says. To be sure, they differ in far more than their machine types and capacities, but even these differences are opaque to OEMs, who themselves might be sourcing parts through purchasing professionals who don’t necessarily discern the different machining needs of different parts. Examples of the kinds of routine mismatches that result include RFQs for five-axis jobs being sent to three-axis shops, and large parts left hanging off the machine bed because the job was won by a shop with not quite the right work envelope size. And this says nothing of the complex part that cannot be machined efficiently by a given shop because it lacks a multitasking turning machine with the right Y-axis travel.

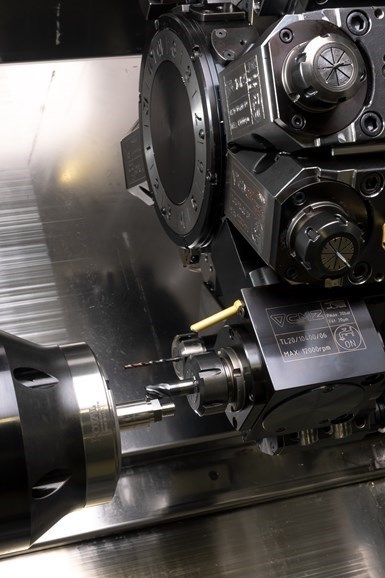

The work envelope of multitasking machines is an example of a capability metric useful for prequalifying shops. (This photo from Prosper-Tech Machine & Tool, which we wrote about here.)

On a multitasking machine, Pakalski notes there are fundamental characteristics important to qualify a given supplier to run a job. They include machine envelope in diameter and length; the various axes useful to the part and their travels; and the orientation of the spindle. From there, other machine parameters might prove valuable as additional qualification constraints. Meanwhile, other machine tool types have their own sets of important parameters. In characterizing machines, he says the team has focused on specifications apt to be germane to successfully machining parts needed by the space sector (the founders’ home field). Ultimately, interrogating the CAD file will allow for automatically identifying the machining process and the specific machine tool specs the part needs, including optional spec requirements added by the user, and Datum’s system will then be able to layer other considerations into the qualification such as a shop’s quality capabilities and its proximity to buyer.

It is a difficult analysis for software to perform automatically, but that is the aim. “We will start with space because we want to be able to nail one industry,” he says. The team will proceed industry by industry from there, and also proceed into other processes beyond CNC machining.

A test of 100 representative machined parts for the space sector so far shows Datum’s platform delivering 80% success at matching parts to correct shops. Further refinement can raise this to near 100%, the CEO says. When I spoke to him, there were 60 machining suppliers Datum had gathered into the platform that could be discovered there. He expects the number to be 100 by the time you read this, and more by the time this capability is tested as a sourcing resource by early OEM users.

Machine shops brought into the platform provide needed data about their machines and capabilities. They will also be able to freely flag and unflag their status as accepting work. Shops’ inclusion will be free of charge, Pakalski says, because Datum expects to profit by selling access to the manufacturing buyers, who need the assist in filtering and identifying suppliers. Once the buyer finds a promising supplier through the system, the buyer will communicate and contract with the shop directly.

“We won’t be a broker — we don’t want that role,” he says. Value will instead come from saving time for manufacturing buyers and delivering better manufacturing by more cleanly and accurately connecting parts to producers. OEMs will pay to employ the system, and to realize this value. For this reason, the Datum team expects shops will want to join and be discoverable there. In other words, Pakalski expects shops will want to be part of a network that is discerning and sensitive enough to sometimes rule them out.

Related Content

The Role of Surface Finishing in Modern Manufacturing: Trends and Best Practices

You’re attending IMTS to advance your business. Regardless of your role in the manufacturing process, considering how your parts will be finished is crucial. This article can help you understand trends in surface finishing and better communicate with your finishing partners.

Read MoreFunction Over Form

While the metalworking industry includes a wide variety of machine shops, it is worthwhile remembering that the differences obscure a key commonality: they all run on human ingenuity.

Read MoreHow to Meet Aerospace’s Material Challenges and More at IMTS

Succeeding in aerospace manufacturing requires high-performing processes paired with high-performance machine tools. IMTS can help you find both.

Read MoreHow a Custom ERP System Drives Automation in Large-Format Machining

Part of Major Tool’s 52,000 square-foot building expansion includes the installation of this new Waldrich Coburg Taurus 30 vertical machining center.

Read MoreRead Next

AMRs Are Moving Into Manufacturing: 4 Considerations for Implementation

AMRs can provide a flexible, easy-to-use automation platform so long as manufacturers choose a suitable task and prepare their facilities.

Read MoreLast Chance! 2025 Top Shops Benchmarking Survey Still Open Through April 30

Don’t miss out! 91ÊÓƵÍøÕ¾ÎÛ's Top Shops Benchmarking Survey is still open — but not for long. This is your last chance to a receive free, customized benchmarking report that includes actionable feedback across several shopfloor and business metrics.

Read MoreMachine Shop MBA

Making Chips and 91ÊÓƵÍøÕ¾ÎÛ are teaming up for a new podcast series called Machine Shop MBA—designed to help manufacturers measure their success against the industry’s best. Through the lens of the Top Shops benchmarking program, the series explores the KPIs that set high-performing shops apart, from machine utilization and first-pass yield to employee engagement and revenue per employee.

Read More