Share

It can be dangerous for a machine shop to be too closely tied with any one customer or industry. However, it can also be challenging for a shop to diversify into new, unfamiliar markets. Ultimately, its big question is:

What do original equipment manufacturers (OEMs) and Tier-Ones and Tier-Twos look for in a supplier of their machined parts?

To get some insight about this, I spoke with Greg Renfro, retired vice president for (NOV). Headquartered in Houston, Texas, NOV is one of the largest manufacturers of oil and gas drilling equipment in the world, and Mr. Renfro says it has more than 250 different companies under its umbrella (not including the many outside suppliers it uses).

In fact, I was put in touch with him via an impromptu sort of supply chain of my own. For this story, I reached out to Patricia Panchak, an experienced journalist and speaker specializing in manufacturing and business, who contacted Paul Erickson, a retired supply management professional with 38 years of industry experience. Mr. Erickson suggested that I contact Mr. Renfro, pointing to his extensive knowledge of machining, as well as experience setting up new NOV manufacturing facilities around the world and helping vet potential new suppliers in his 36 years with the company. Although retired, Mr. Renfro says he still works with NOV, primarily supporting the company’s legal team.

Must Haves

Here, he cites certain traits any prospective shops hoping to work with NOV had to have. While some of these are specific to the oil industry, many would apply to other industries as well.

Sound financials.

All suppliers were first audited to ensure they were fiscally sound. A good as well as (FCPA) compliance were paramount. Shops with poor credit or outstanding judgments were not considered, as those show there’s no guarantee the shop will be around for the long haul. Financial stability and an active management team looking to improve their services and volume are positive signs.

The right equipment.

The types of machined parts needed for deep-sea and land-based oil and gas drilling equipment could largely be divided into two types: relatively small and very big. Mr. Renfro says there are many shops that could accurately machine small parts, even though those parts often have tight tolerances and might be made of challenging materials such as Inconel, Monel and high-strength alloy and stainless steel. The bigger challenge for NOV was finding shops with equipment such as large boring mills, turn-mills and vertical turning lathes (VTLs) that could handle, for example, forgings as heavy as 60 tons.

Competitive pricing.

It’s one thing if there are only one or two shops that can perform a certain machining operation, but this typically isn’t the case. Although price might not be the only consideration, it is one of the first and most visible. That said, there can be situations in which it makes sense to pay a premium for a given part if it is required to complete an assembly in a timely manner so as not to incur added cost due to assembly delay. In addition, components must be delivered in as short a lead time as possible, and the shop must have excellent on-time delivery rates.

Formal quality program.

The processes used by shops to plan and schedule their work weren’t necessarily relevant, provided they managed and maintained documentation and traceability in accordance with their quality systems. ISO certification was required, as was American Petroleum Institute (API) licensing depending on the work being performed. Traceability was generally required all the way back to raw material.

Diversified customer base.

It can be concerning to an OEM if it represents too high a percentage of a shop’s business. Many industries—oil in particular—are cyclical, so a downturn could be disastrous for that shop. Mr. Renfro never wanted NOV to represent more than 25 to 30 percent of a shop’s business. Conversely, he wanted that percentage to be significant enough so the shop remained a focused and loyal supplier.

Plusses, Too

In addition to Mr. Renfro’s musts are “plusses” he liked to see in a shop:

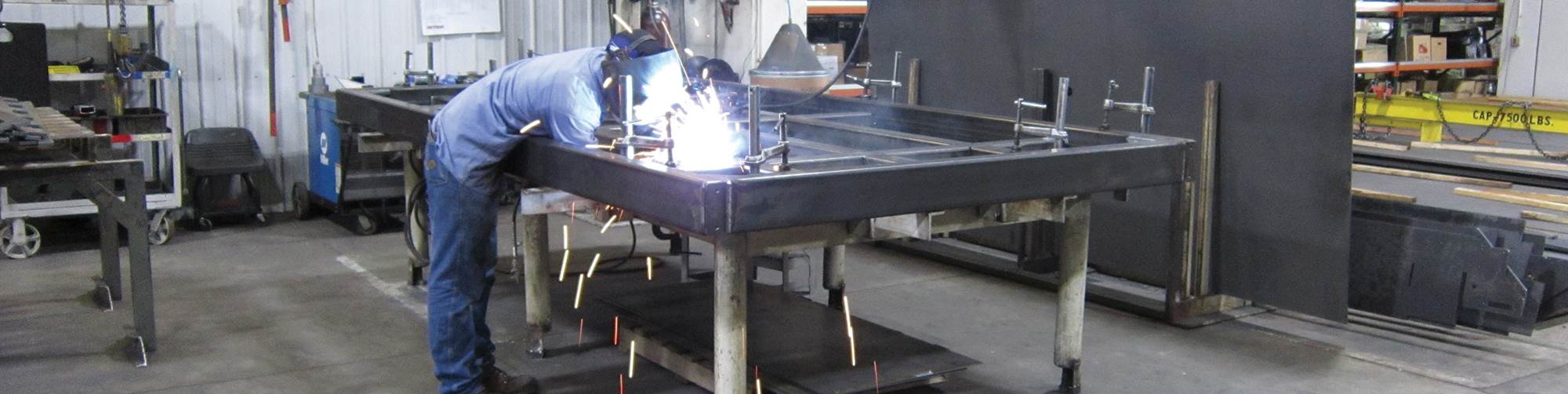

More than machining.

A shop having broad capability and in-house fabrication, machining, assembly, painting and so on were more desirable. These shops could typically deliver components quicker, as they have greater control over all the processes required to complete a part. Plus, this can eliminate any finger-pointing when issues arise.

Good shop appearance.

It’s easy to get a feel for a shop by walking through its facility. Is equipment well-maintained and the facility generally clean with a sensible layout? Is the shop applying 5S workplace organization practices? Do the shopfloor employees have good attitudes, or do they have their heads down because they seemingly dread their jobs? Is there signage that is worker- and quality-focused? How is work in process (WIP) staged, and for how long has it been staged, waiting for the next process?

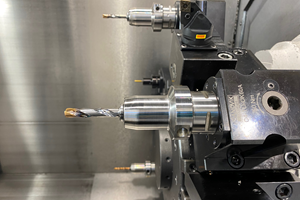

Eye toward new technology.

Multitasking machines such as turn-mills are advantageous in that they can reduce machining lead time, cost and WIP by, in many cases, performing all operations in one setup. That said, it was not a deal breaker if a shop did not have that equipment, so long as parts were delivered on time and to specification. However, Mr. Renfro appreciates shops that continue to invest in new machining technology as a means to further reduce lead times and costs. One such technology is on-machine touch probing and measurement arms and lasers (for big parts), which enable measurements to be taken without removing the part from the machine.

Related Content

Custom PCD Tools Extend Shop’s Tool Life Upward of Ten Times

Adopting PCD tooling has extended FT Precision’s tool life from days to months — and the test drill is still going strong.

Read MoreBriquetting Manufacturer Tools Up for Faster Turnaround Times

To cut out laborious manual processes like hand-grinding, this briquette manufacturer revamped its machining and cutting tool arsenal for faster production.

Read MoreForm Tapping Improves Tool Life, Costs

Moving from cut tapping to form tapping for a notable application cut tooling costs at Siemens Energy and increased tool life a hundredfold.

Read MoreOrthopedic Event Discusses Manufacturing Strategies

At the seminar, representatives from multiple companies discussed strategies for making orthopedic devices accurately and efficiently.

Read MoreRead Next

Last Chance! 2025 Top Shops Benchmarking Survey Still Open Through April 30

Don’t miss out! 91ÊÓƵÍøÕ¾ÎÛ's Top Shops Benchmarking Survey is still open — but not for long. This is your last chance to a receive free, customized benchmarking report that includes actionable feedback across several shopfloor and business metrics.

Read MoreMachine Shop MBA

Making Chips and 91ÊÓƵÍøÕ¾ÎÛ are teaming up for a new podcast series called Machine Shop MBA—designed to help manufacturers measure their success against the industry’s best. Through the lens of the Top Shops benchmarking program, the series explores the KPIs that set high-performing shops apart, from machine utilization and first-pass yield to employee engagement and revenue per employee.

Read MoreAMRs Are Moving Into Manufacturing: Considerations for Implementation

AMRs can provide a flexible, easy-to-use automation platform so long as manufacturers choose a suitable task and prepare their facilities.

Read More