Metalworking Activity Starts 2022 With Modest Boost

GBI: Metalworking reflected greater levels of activity in new orders, production and backlogs with a modest increase for January 2022.

Share

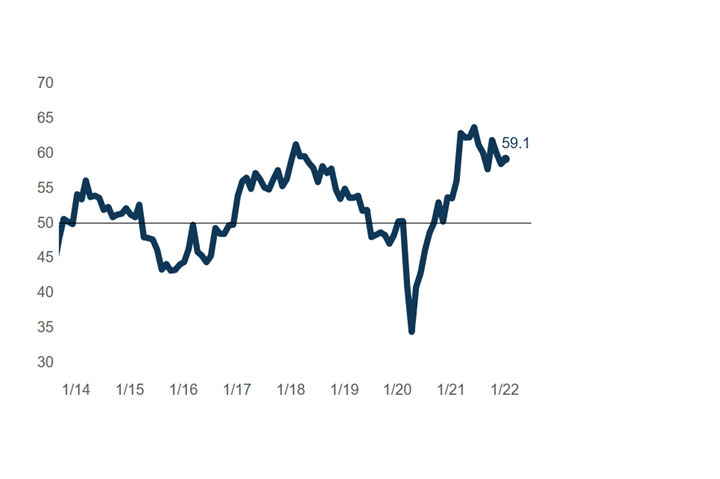

January’s total business activity according to the Gardner Business Index (GBI): Metalworking increased nearly one point to close at 59.1.

GBI: Metalworking Index

The Metalworking Index started 2022 modestly stronger thanks to an accelerating expansion in new orders, production and backlog activity. Images: Gardner Intelligence

Greater levels of activity in new orders, production and backlogs all contributed to the month’s overall gain. January’s supplier deliveries reading also increased; however, in the present environment, rising readings indicate weakening supply chain performance. Those business activity readings which posted lower readings than last month’s include employment and export orders. January’s export reading fell below 50, indicating contracting activity. Separately, the decline in employment activity indicated only slowing expansion.

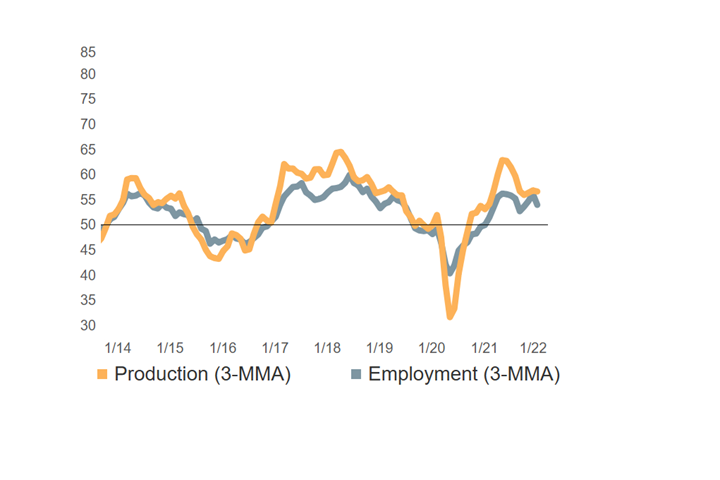

Production and Employment Activity: Doing More With Less

Production activity has remained robust over the last six months despite a relatively weak employment market and struggling supply chains. Graph is based on three-month moving averages.

Over the last six months, metalworking job shops have learned to do more with less. Since August, production readings have remained in a tight range with an average reading near 56. Historically, such strong performance has only been reported during expansionary phases of the business cycle and recalls the expansionary periods of 2014-2015 and 2017-2018. This time, however, the business cycle is different as manufacturers contend with a very tight labor market and weak supply chains. Finding ways to raise production to meet heightened demand with fewer workers and crippled supply chains is and will remain a challenge for the foreseeable future.

Related Content

-

Metalworking Activity Remained on a Path of Contraction

Steady contraction of production, new orders and backlog drove accelerated contraction in November.

-

Last Chance! 2025 Top Shops Benchmarking Survey Still Open Through April 30

Don’t miss out! 91ÊÓƵÍøÕ¾ÎÛ's Top Shops Benchmarking Survey is still open — but not for long. This is your last chance to a receive free, customized benchmarking report that includes actionable feedback across several shopfloor and business metrics.

-

Metalworking Index Shows Continued Recovery

December marks third consecutive month of metalworking improvement on the heels of increased supplier deliveries.

.jpg;width=70;height=70;mode=crop)