Metalworking Activity Stays Flat in October

The GBI for Metalworking reflects stability of most of the six GBI components that had been losing ground months prior. Ordinarily underwhelming, flat is good when it means not contracting.

Share

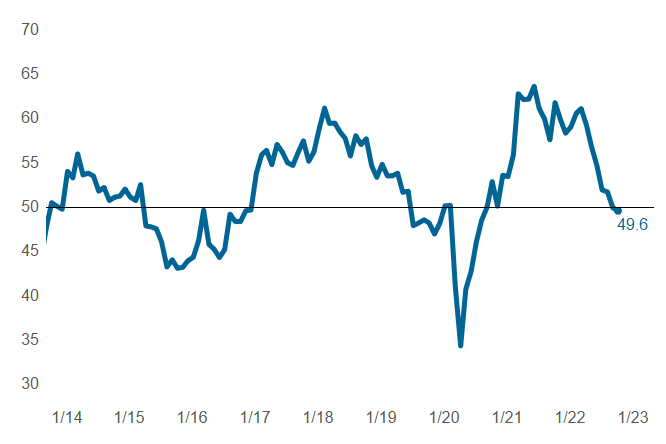

The Gardner Business Index for Metalworking hovers around 50 (49.6, to be exact) for the second month in a row, reflecting stability of most of the six GBI components that had been losing ground months prior.

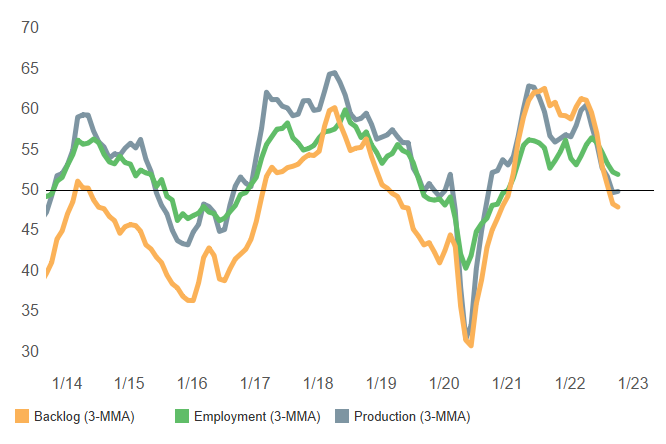

New orders and exports contracted again, but at slower rates than in September, landing on top of each other in October. Employment and production hint at leveling off in October. Backlog is essentially unchanged, in part a function of contracting new orders. Supplier deliveries continue to lengthen at slower rates, entering levels in line with more typical, pre-pandemic readings. While employment stands alone in growth mode, reports of having more employees does not mean there are enough.

Metalworking GBI is essentially flat in October, reflecting mostly flat components. Photo Credit: Gardner Intelligence

Production stayed flat in October. Backlog and employment slowed in October, both landing close to September levels of contraction and growth, respectively. (3-MMA = three-month moving averages). Photo Credit: Gardner Intelligence

Related Content

-

Metalworking Activity is on a Roll, Relatively Speaking

February closed at 47.7, up 1.4 points relative to January, marking the third straight month of slowed contraction.

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.

-

Market Indicators Continue to Soften in Metalworking

The overall metalworking index is down more than a point, but future business is up slightly.